Mortgage lenders will use your credit score to help them decide whether to approve you for the home you want. The better the score, the greater the chance you’ll get the mortgage you’re looking for, and potentially at a lower interest rate. Your credit score is not the entire story. Mortgage lenders will consider more than just your score when underwriting your file. Some additional factors include your employment status/length, income, and savings/assets. So, how can you improve your credit score?

There are many different credit scores a lender can consider. The most common in Canada are provided by the two major credit reporting agencies — Equifax and TransUnion. In addition to that, some lenders have unique custom scores that only exist on their internal systems.

If your score isn’t where you’d like it to be, there are some things you can do to help bring it up.

1. Check your credit report!

When looking to improve your credit scores, a good first step is to review your credit reports from both nationwide credit reporting agencies — Equifax and TransUnion. After making sure there are no accounts you don’t recognize, or signs of identity theft or fraud, check to see if you have any unpaid balances or past-due accounts that have gone to collections. It’s a good idea to tackle this negative information first by paying off as many outstanding debts as you can. Remember that although it’s important to pay any accounts in collections, they will remain on your credit bureau for a period of six years from the time they went into collections.

2. Always pay your bills on time

One of the top things you can do to lift your credit score is to pay your bills on time. Payment history is a significant piece of what makes up the entire score, so it’s critical to avoid late payments. If you struggle with this, talk to your bank about setting up automatic payments or set calendar reminders to help you pay on time.

3. Don’t max-out your balances

Your credit utilization ratio is the amount of overall credit (limit) you have compared to the balance that is reported to the credit bureau. For example, if your credit limit is $10,000 and your reported monthly balance is usually about $3,000, then your credit utilization rate is 30 per cent. It’s best to keep your credit utilization rate at or below 30% when possible. If that’s not an option, then try to keep it under 75% if you can. You can do this by spending less on credit, making more frequent (more than once-a-month) payments, or asking your credit card company for a credit limit increase.

4. Limit new accounts

Applying for new credit accounts (especially non-mortgage accounts) will usually lead to a hard inquiry on your credit report. This can negatively affect credit scores for a short period of time, particularly if you’re at the lower end of the credit score spectrum. If increasing your score is your goal, try to limit how often you apply for new accounts. Opening a new credit card or loan account will also decrease the average age of accounts on your report, which is another factor used in calculating your credit scores.

5. Keep your accounts open

When trying to increase your score, avoid closing old accounts that have been paid off, even if you no longer use them. One of the factors in credit scores is “average age of accounts,” so keeping the accounts open can help maintain the length of your credit history.

When will my score increase?

The amount of time it takes to improve a credit score varies depending on your circumstances, but it will require a bit of patience and won’t happen right away. Some negative factors are easier to overcome than others.

It may take you less time to recover from one late payment or a few hard inquiries than from having an account go into collections. A consumer proposal or bankruptcy will take even longer to recover from. Just remember to keep at it! Improving your credit takes effort and time. There’s no one-size-fits-all solution that will change your credit score overnight. Every little bit counts!

Reach out to us today for a free assessment of your credit and personal financial situation. We can Guide you through the steps needed to get you approved for a mortgage!

Your Dream Home Awaits: A REALTOR®’s Guide to Credit Mastery!

Hello future homeowners!  As your dedicated REALTOR®, I’m thrilled to share some insider tips on navigating credit for that perfect home purchase, brought to you by @AdvancedMortgage.

As your dedicated REALTOR®, I’m thrilled to share some insider tips on navigating credit for that perfect home purchase, brought to you by @AdvancedMortgage.

1. Credit Health Check: Let’s kick off your journey with a comprehensive credit report check from Equifax and TransUnion. Together, we’ll ensure your credit is in top-notch shape—no surprises, no red flags. Your dream home deserves a clean slate!

2. Timely Payments Matter: Paying your bills on time is crucial. We can explore options like automatic payments or set up handy calendar reminders to keep you on track and avoid those pesky late fees.

3. Smart Balancing Act: We’ll strategically manage your credit utilization – aiming for that sweet spot below 30%. Need some pro tips? Count on us for savvy solutions.

4. New Isn’t Always Better: Together, let’s navigate the impact of new credit accounts on your report. Too many inquiries can raise eyebrows. We’ll create a plan to maintain a smooth and steady course.

5. Age Before Beauty: Old accounts hold significant weight. Even if they’re paid off and quietly resting, we’ll keep them open to preserve that valuable “average age of accounts.”

Your Journey to Improvement: Patience is our ally. While improvement timelines may vary, every step counts. Let’s work hand in hand, shaping the path to your dream home!

Ready for a tailored credit assessment and seamless mortgage guidance? Reach out for a complimentary consultation today! Together, we’ll turn your homeownership dreams into reality.

Contact me for more information about why now is a great time to buy!https://robynmoser.com/

Ready to Seize Homeownership? Buy Now or Rent and Wait?

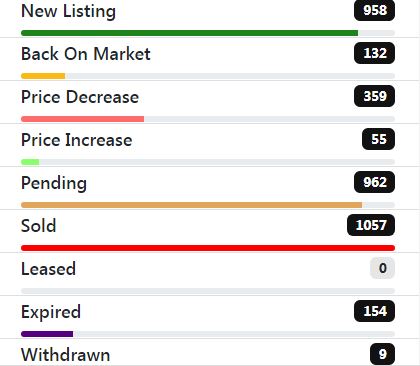

Ready to Seize Homeownership? Buy Now or Rent and Wait? Now’s the time to act:

Now’s the time to act: Calgary and area home prices are increasing, forecasting 5%-10%+ growth in 2024. Waiting could turn a $300,000 home into a $315,000 investment. [More insights at @advancedmortgage]

Calgary and area home prices are increasing, forecasting 5%-10%+ growth in 2024. Waiting could turn a $300,000 home into a $315,000 investment. [More insights at @advancedmortgage] Watch inflation and Canadian Bond Yields for potential changes in the Bank of Canada Prime rate.

Watch inflation and Canadian Bond Yields for potential changes in the Bank of Canada Prime rate. Get Pre-Approved: Stand out as a serious buyer.

Get Pre-Approved: Stand out as a serious buyer. Work with Professionals: I have many professional referrals sources to help you with the process, our professional connection will ensure you have a successful journey! For mortgages, contact @AdvancedMortgage for seamless collaboration.

Work with Professionals: I have many professional referrals sources to help you with the process, our professional connection will ensure you have a successful journey! For mortgages, contact @AdvancedMortgage for seamless collaboration.