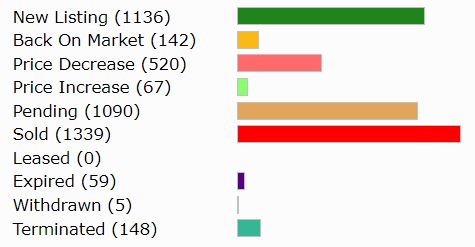

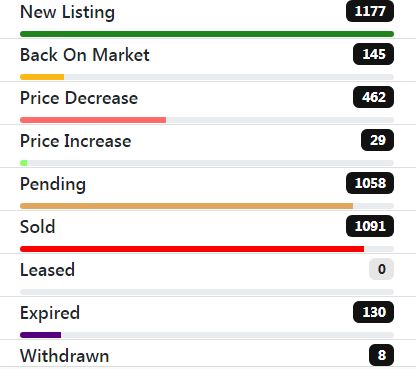

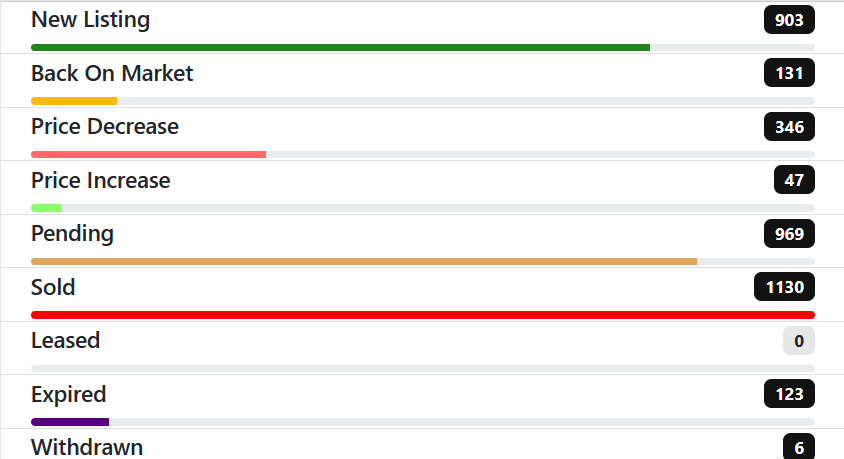

Weekly Calgary Real Estate Update For April 22/ 2024

3605 homes for sale in metro Calgary (up 22)

2745 homes sold in the last 30 days (up 93)

1.31 months worth of inventory (down 0.04)

76.14% of the homes statistically to sell in the next 30 days (up 2.12%)

Market Conditions: Seller’s Market

Average List Price: $592,896 (up $3,966)

Average Sale Price: $599,120 (up $5,056)

Average days on market: 23 (up 1)

Average list to sale price ratio : 101.58% (up 0.09%)

*Numbers in the brackets are a comparison from last week’s stats. Ideally, we want the number of homes selling in the last 30 days to increase weekly, the months of inventory to decrease (meaning demand is matching inventory) and the % of homes to sell in the next 30 days to increase.